The smart Trick of Home Warranty Insurance Cost That Nobody is Discussing

Table of ContentsThe Only Guide for Home Warranty Insurance Cost3 Easy Facts About Home Warranty Insurance Cost ExplainedHome Warranty Insurance Cost Fundamentals ExplainedSome Known Facts About Home Warranty Insurance Cost.The 20-Second Trick For Home Warranty Insurance CostSee This Report about Home Warranty Insurance Cost

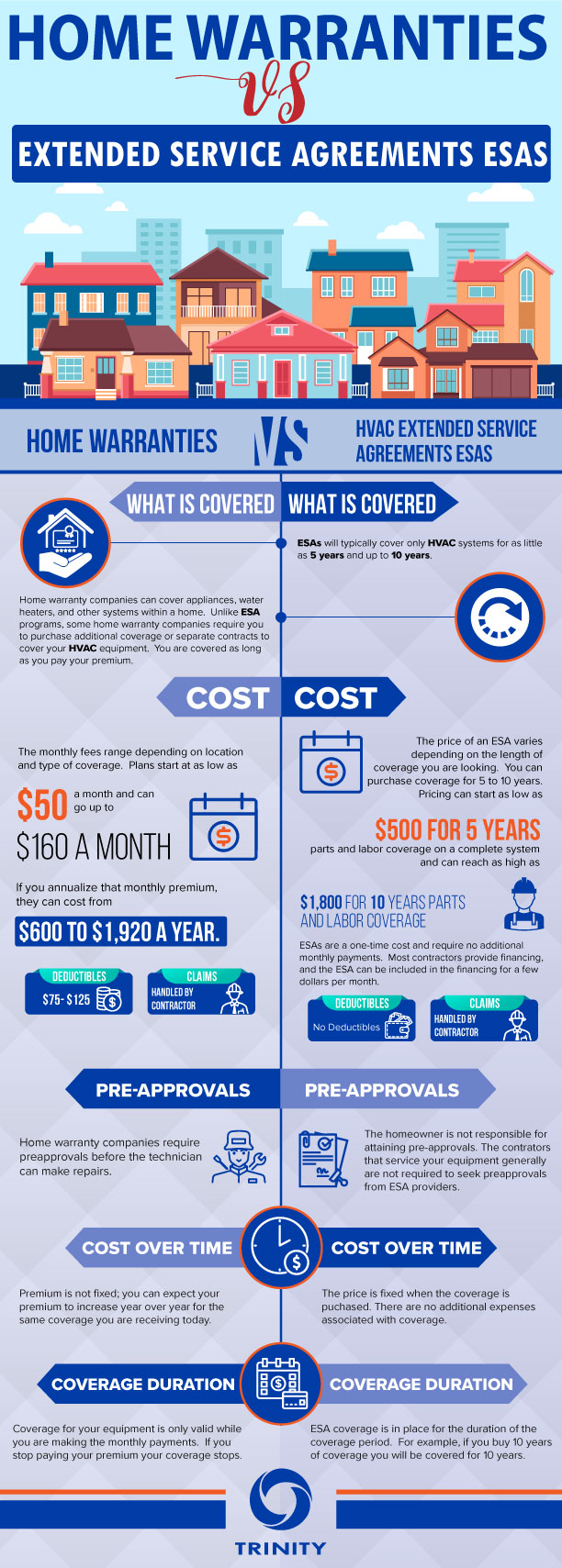

For one, homeowners insurance policy is needed by lending institutions in order to obtain a home loan, while a residence warranty is entirely optional. As stated over, a residence guarantee covers the repair service and also substitute of things as well as systems in your residence.Your property owners insurance policy, on the other hand, covers the unexpected. It will not assist you change your home appliances because they got old, but house owners insurance might aid you obtain new home appliances if your existing ones are harmed in a fire or flooding.

Just how much does a residence warranty cost? House warranties usually set you back in between $300 and $600 per year; the expense will differ depending on the kind of plan you have.

A Biased View of Home Warranty Insurance Cost

Depending upon your strategy, that can be per thing or repair, or maybe a total ceiling. Simply put, as soon as you hit the cap, you're paying of pocket. Should you get a residence guarantee? Having your cooling dealt with under a home service warranty will probably cost much less than paying to have it changed without one.

/Sears_Home_Warrenty_Recirc-1796fd7da4f040a29c803e29154f60fe.jpg)

Getting The Home Warranty Insurance Cost To Work

When checking out the summary of a service contract or a residence guarantee, they can look extremely comparable as well as make you question, "What IS the difference between these?" It's an usual concern, yet recognizing the difference is essential when picking which one is the most effective fit for you and also your residence.

Home Service warranties Automobiles as well as mobile phones aren't the only products with a warranty as you can purchase one for your residence, too. When something covered by a home warranty breaks down, the property owner calls for service.

What do you leave a home guarantee? The benefit of having a residence guarantee is the confidence that you can relocate without needing to pay out big quantities of added money for fixings you weren't anticipating. House owners with newly built residences can acquire residence service warranties, as well. You're believing, yet, every little thing is brand-new.

The Ultimate Guide To Home Warranty Insurance Cost

/Sears_Home_Warrenty_Recirc-1796fd7da4f040a29c803e29154f60fe.jpg)

The agreement with one of the most protection costs regarding $30 per month or $360 per year. The arrangement covering your standard home heating as well as air conditioning expenses around $20 each month or $240 each year. There are arrangements in between as well as one for every home owner's needs.

It's likewise vital to extensively check out all plan documents since both the benefits and drawbacks can differ based on your area and also the kind of plan you select. Right here are some factors to consider to think about prior to acquiring a strategy: Not Whatever Is Covered Unfortunately, your house guarantee doesn't cover every little thing.

Home Warranty Insurance Cost Fundamentals Explained

Still, is assurance ever before a waste? - home warranty insurance cost.

Total yearly costs vary in between $264 as well as $1,425 annually, depending upon the service provider and also level of coverage. In addition to the cost of the plan, the warranty business bills a service telephone call cost each time you submit a case that results in sending out a gotten professional to your home.

Normally, the higher your solution phone call cost, the more affordable your month-to-month or yearly costs will certainly be. Many companies provide a fixing guarantee that stops you from paying a service call fee greater than when in a defined time duration if a repair work isn't effective as well as a contractor has to return.

The Single Strategy To Use For Home Warranty Insurance Cost

When a covered product breaks down, you go on the internet or contact us to sue, and the business discovers an accredited professional to send click over here to your home. Nevertheless, many people with home service warranties wind up not utilizing them, which is one prospective drawback. You should likewise think about the restrictions and also exclusions of the service warranty contract, consisting of payment caps as well as left out components of protected items.

On the high end of the range, the typical expense is $68. 71 per month., where you live, the size of your residence and also various other aspects.