Indicators on Home Warranty Insurance Cost You Need To Know

Table of ContentsHome Warranty Insurance Cost for DummiesThe 30-Second Trick For Home Warranty Insurance CostSome Ideas on Home Warranty Insurance Cost You Need To KnowExcitement About Home Warranty Insurance CostHome Warranty Insurance Cost Things To Know Before You Get ThisNot known Incorrect Statements About Home Warranty Insurance Cost

house insurance, A home guarantee is not the exact same as house owners insurance. For one, property owners insurance coverage is called for by lenders in order to obtain a home mortgage, while a residence warranty is entirely optional. The bigger distinctions are in what they cover and also just how they function. As stated over, a residence guarantee covers the fixing and also substitute of products as well as systems in your house.Your homeowners insurance coverage, on the various other hand, covers the unexpected. It won't assist you replace your devices since they got old, yet homeowners insurance coverage might aid you obtain new devices if your existing ones are harmed in a fire or flood.

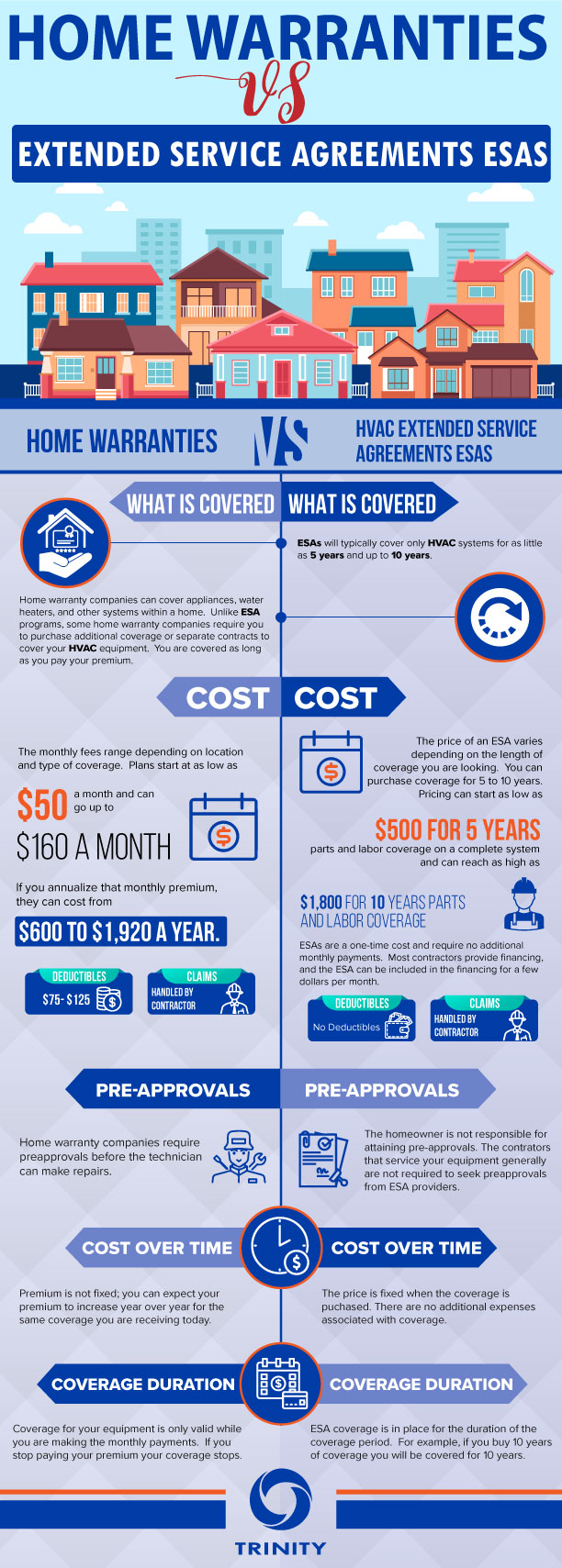

Exactly how much does a house service warranty price? Home service warranties typically set you back between $300 as well as $600 each year; the price will vary depending on the sort of plan you have. The more that's covered, the costlier the plan those add-ons can accumulate. Where you live can also influence the expense.

What Does Home Warranty Insurance Cost Mean?

Should you obtain a house warranty? Having your air conditioning dealt with under a house warranty will almost absolutely cost much less than paying to have it changed without one.

The Home Warranty Insurance Cost Diaries

When checking out the description of a service arrangement or a home service warranty, they can look very comparable and make you question, "What IS the difference in between these?" It's a typical inquiry, but understanding the difference is necessary when choosing which one is the very best suitable for you and your residence.

Residence Warranties Cars and also smartphones aren't the only products with a warranty as you can purchase one for your home, too. When something covered by a residence warranty breaks down, the property owner calls for service.

What do you leave a residence guarantee? The benefit of having a home warranty is the peace of mind that you can relocate without needing to pay big quantities of additional money for repair services you weren't expecting. Property owners with recently developed houses can acquire house warranties, also. You're believing, yet, everything is new.

Home Warranty Insurance Cost for Beginners

The contract with the most coverage prices regarding $30 monthly or $360 per year. The agreement covering your fundamental home heating and also cooling costs around $20 per month or $240 per year. There are This Site arrangements in between and also one for every single home owner's demands.

It's likewise critical to completely check out all strategy documents since both the advantages and disadvantages can vary based upon your place and also the kind of plan you pick. Here are some factors to consider to think about prior to buying a plan: Not Every little thing Is Covered Regrettably, your home service warranty does not cover everything.

Home Warranty Insurance Cost - Questions

Still, is comfort ever before a waste? - home warranty insurance cost.

Total annual costs vary in between $264 as well as $1,425 annually, depending on the company and degree of protection. Along with the expense of the plan, the service warranty company charges a solution call charge each time you sue that results in sending an acquired specialist to your house.

Normally, the greater your solution phone call cost, the less expensive your month-to-month or yearly costs will be. A lot of service providers use a repair service guarantee that stops you from paying a solution phone call cost more than once in a defined period if a repair service isn't successful and a service provider needs to return.

Home Warranty Insurance Cost - The Facts

When a covered thing breaks down, you browse the web or phone call to sue, as well as the company finds a certified professional to send out to your house. Many people with house warranties end up not using them, published here which is one potential downside. You must likewise take into consideration the restrictions and exclusions of the guarantee agreement, consisting of payout caps and excluded elements of covered items.

On the high end of the range, look at this website the ordinary price is $68. 71 per month., where you live, the dimension of your home and various other variables.